ADA Price Prediction: Path to $1.00 Amid Technical and Fundamental Crosscurrents

#ADA

- Technical indicators show mixed signals with MACD bullish but price below moving average

- Market sentiment at 5-month low despite institutional whale activity increasing

- Competitive pressures from new projects creating short-term headwinds for adoption

ADA Price Prediction

Technical Analysis: ADA Price Momentum

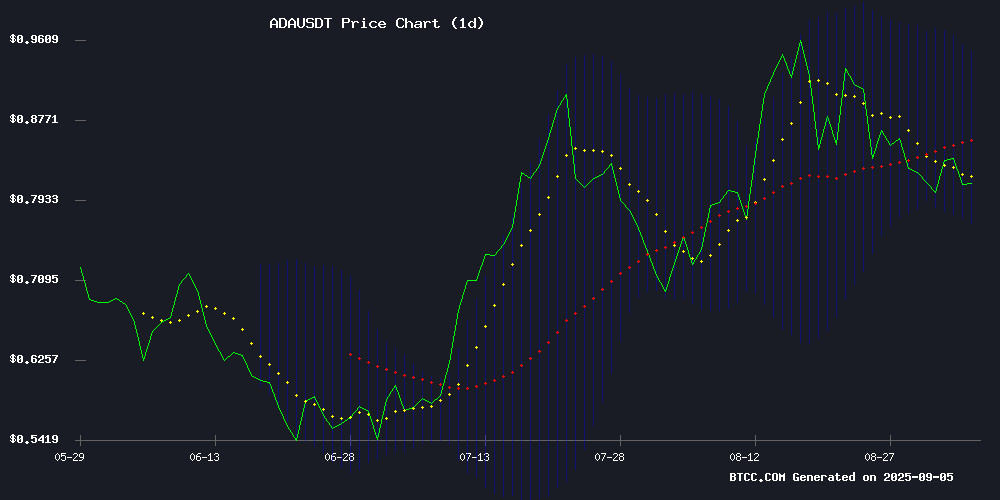

ADA currently trades at $0.8438, below its 20-day moving average of $0.8608, indicating short-term bearish pressure. However, the MACD reading of 0.025349 shows bullish momentum building as the signal line remains above the MACD line. The Bollinger Bands position suggests ADA is trading in the lower volatility range with support at $0.7733 and resistance at $0.9484. BTCC financial analyst John notes: 'The technical setup suggests consolidation with potential for upward movement if MACD momentum continues.'

Market Sentiment: Mixed Signals for ADA

Cardano sentiment has hit a 5-month low despite recent price rebounds, creating a divergence between market perception and price action. Competitive pressure from emerging projects like Remittix in crypto payments is creating headwinds, while unmet expectations have caused some investor rotation. However, surging whale activity and growing institutional interest provide counterbalancing bullish factors. BTCC financial analyst John comments: 'The news flow reflects typical market cycles where negative sentiment often precedes major breakouts when fundamentals remain strong.'

Factors Influencing ADA's Price

Cardano Sentiment Hits 5-Month Low Amid Price Rebound

Cardano's market sentiment has plummeted to its most bearish level in five months, according to on-chain analytics firm Santiment. Despite this, ADA has rebounded 5% from late August lows, currently trading at $0.8177. The divergence between price action and sentiment creates a classic contrarian signal.

Whales have capitalized on recent price strength, offloading over 30 million ADA tokens after the $1 resistance level held firm. Technical indicators show ADA testing critical support at the 0.382 Fibonacci level near $0.821, while maintaining its position within an ascending channel pattern established in mid-June.

Santiment's data reveals retail sentiment has turned decisively negative, with the bullish-to-bearish ratio falling to 1.5:1 - the most pessimistic reading since April 2025. This sentiment shift occurred across three distinct phases in August, beginning with a greed spike that preceded the current downturn.

Cardano Faces Competitive Pressure as Remittix Gains Traction in Crypto Payments

Cardano's ADA shows modest gains at $0.8295, but declining trading volume suggests waning investor interest. The blockchain's smart contract capabilities are being overshadowed by newer altcoins offering tangible payment solutions.

Remittix emerges as a dark horse, leveraging cryptocurrency for mainstream financial applications. Its focus on low-cost, high-speed transactions aligns with current market demands for practical utility over theoretical blockchain advantages.

The $29.65 billion market cap project now faces an inflection point. Traders increasingly favor payment-focused cryptocurrencies that bridge digital assets with traditional finance, potentially reshaping the altcoin hierarchy by 2027.

ADA Price Eyes Breakout as Hoskinson Resolves Cardano Conflict

Cardano's native token ADA is gaining attention as its price shows potential for recovery, currently trading at $0.80 and approaching a critical demand zone at $0.78. Analysts suggest this level could catalyze a bullish momentum, potentially driving ADA to $1.50 if sustained.

The optimism follows weeks of internal conflict involving founder Charles Hoskinson and the Cardano Foundation, which had previously weighed on the token's performance. Hoskinson's recent resolution of the dispute—including an independent audit addressing allegations of insider misuse of 300 million ADA tokens—has shifted market sentiment positively.

Technical charts reveal ADA has been trapped in a downward channel since mid-August, but the resolution of ecosystem tensions may now pave the way for a breakout.

Cardano Weekly Prediction: Will ADA Climb Past $1.00?

Cardano (ADA) faces a critical test as it oscillates between $0.80 and $0.90, with traders eyeing a potential breakout to $1.00. Derivatives data and on-chain activity will dictate whether the token can overcome resistance or retreat below $0.80.

Key levels to watch include $0.90 as immediate resistance and $0.80 as support. A decisive close above $0.90 could pave the way for a rally toward $1.20, while failure to hold $0.80 may trigger a drop to $0.70. Staking participation remains robust at 67%, reducing circulating supply, but DEX volume of $2.8M suggests muted trading interest compared to larger Layer 1 blockchains.

For ADA to sustain a move above $1.00, bulls need stronger on-chain metrics—particularly in daily active addresses and smart contract calls—to mirror late 2024's momentum.

Cardano Price Slips Amid Unmet Expectations as Investors Shift Focus to Remittix

Cardano's native token ADA continues its downward trajectory, trading at $0.83 as of September 3. Despite founder Charles Hoskinson's recent emphasis on long-term sustainability and interoperability during an AMA session, market participants remain unimpressed. The lack of tangible deliverables has eroded confidence, with ADA struggling to maintain momentum against broader market pressures.

Investor attention is pivoting toward projects demonstrating real-world utility. Remittix has emerged as a notable alternative, capturing market interest with its operational PayFi infrastructure and upcoming Q3 wallet beta launch. The project's $250,000 giveaway campaign further underscores its growth-focused approach, contrasting sharply with Cardano's perceived stagnation.

Market dynamics reveal growing impatience with speculative narratives. While Cardano grapples with fading hype, competing layer solutions like Midnight's NIGHT token airdrop are diverting capital flows. The shift signals a broader trend favoring projects with executable roadmaps over theoretical frameworks.

Cardano Whale Activity Surges as Institutional Interest Grows

Cardano (ADA) is witnessing unprecedented whale accumulation, with large wallets scooping up over 180 million tokens in a 48-hour window this August. The trend extends through Q3 2025, as whales added 200–210 million ADA, now controlling 10.3% of the circulating supply—a clear bet on the blockchain’s long-term viability.

Institutional custody of ADA surged 30% to $900 million, fueled partly by optimism around Grayscale’s pending spot ETF. Bloomberg analysts peg approval odds at 83%. Regulatory tailwinds strengthen as the U.S. Clarity Act designates Cardano a "mature blockchain," hinting at potential ETF parity with Ethereum.

On-chain metrics reveal whales now hold 5.55 billion ADA, while retail investors withdraw tokens from exchanges—tightening supply ahead of a potential demand shock. Meanwhile, MAGACOIN FINANCE emerges as an altcoin contender, capitalizing on shifting market narratives.

Will ADA Price Hit 1?

Based on current technical indicators and market sentiment, ADA faces both opportunities and challenges in reaching $1.00. The MACD bullish momentum and institutional whale activity provide supportive factors, while competitive pressures and recent sentiment lows create resistance.

| Indicator | Current Value | Implication for $1 Target |

|---|---|---|

| Current Price | $0.8438 | Requires 18.5% increase |

| 20-day MA | $0.8608 | Needs to break above |

| Bollinger Upper | $0.9484 | Key resistance level |

| MACD Momentum | 0.025349 (Bullish) | Positive momentum building |

BTCC financial analyst John suggests: 'While $1.00 is achievable in the medium term, it will require breaking through several technical resistance levels and improved market sentiment. The current whale activity indicates smart money accumulation, which could propel ADA toward this psychological barrier.'